Balance the Federal Budget: A Call for Fiscal Responsibility in the Era of Unprecedented Growth

The federal budget has been a contentious issue in the United States for decades, with politicians and policymakers struggling to balance the books while providing for the nation's citizens. As the country continues to grow and prosper, it's more important than ever to prioritize fiscal responsibility and make sure that our government is running smoothly. In this article, we'll explore the importance of balancing the federal budget and provide a comprehensive look at the current state of the nation's finances.

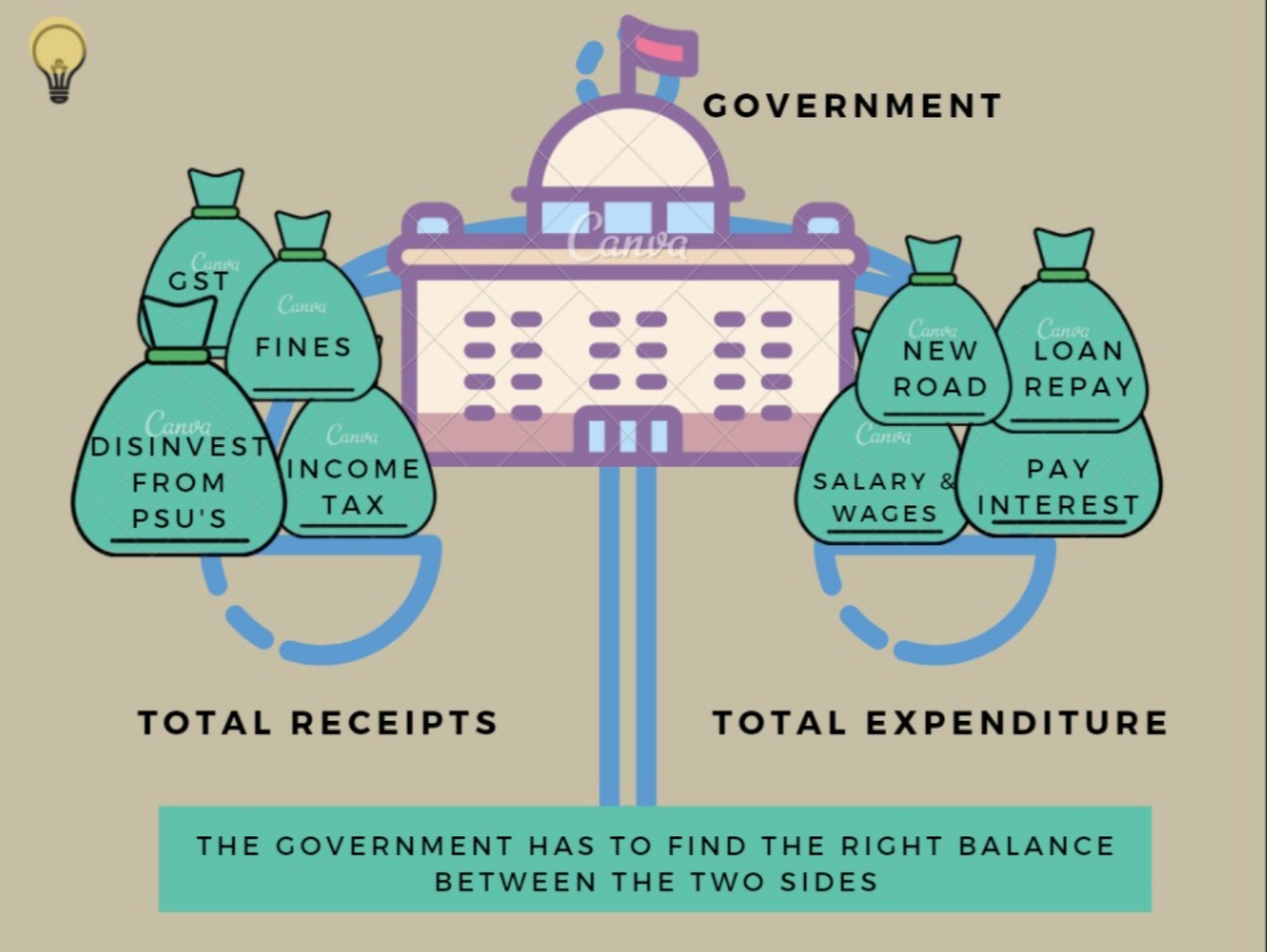

The federal budget is a complex and multifaceted document that outlines the government's spending and revenue for the upcoming fiscal year. It's a critical tool for policymakers, as it allows them to make informed decisions about how to allocate resources and prioritize spending. However, the budget process is often marred by partisanship and gridlock, leading to budgets that are neither sustainable nor responsible.

One of the key challenges facing policymakers is the growing deficit. The federal budget deficit has been steadily increasing over the past few decades, reaching a record high of over $1 trillion in 2020. This is a significant concern, as it can have far-reaching consequences for the economy and future generations. The deficit is not just a matter of fiscal responsibility, but also a threat to national security and economic stability.

Another issue facing policymakers is the growing national debt. The national debt has been rising steadily over the years, reaching over $27 trillion in 2020. This is a staggering amount, and it's a major concern for policymakers who need to balance the budget. The national debt is not just a matter of fiscal responsibility, but also a threat to national security and economic stability.

Understanding the Budget Process

The budget process is a complex and multifaceted document that outlines the government's spending and revenue for the upcoming fiscal year. It's a critical tool for policymakers, as it allows them to make informed decisions about how to allocate resources and prioritize spending.

Here are the key steps involved in the budget process:

- The Office of Management and Budget (OMB) prepares a budget proposal that outlines the government's spending and revenue for the upcoming fiscal year.

- The proposal is then submitted to Congress, where lawmakers review and debate the budget.

- Lawmakers vote on the final budget, which is then signed into law by the President.

- The budget takes effect on October 1st of each year, marking the beginning of the new fiscal year.

Budget Deficit: Causes and Consequences

The federal budget deficit is a major concern for policymakers, as it can have far-reaching consequences for the economy and future generations. So, what causes the deficit, and what are the consequences of ignoring it?

Causes of the Budget Deficit:

- Increased spending: The government spends more on programs and services than it takes in through revenue.

- Decreased revenue: The government takes in less revenue than it needs to cover its spending.

- Tax cuts: The government reduces taxes, which reduces revenue.

- Increased interest payments: The government borrows money to finance its spending, which increases interest payments.

Consequences of the Budget Deficit:

- Inflation: Excessive money printing can lead to inflation, which erodes the purchasing power of consumers.

- Unemployment: A large deficit can lead to higher unemployment, as businesses struggle to compete with each other.

- National debt: A large deficit can lead to a significant increase in the national debt, which can be difficult to pay back.

- Loss of credit rating: A large deficit can lead to a loss of credit rating, making it more expensive for the government to borrow money.

Budget Deficit Reduction Strategies

There are several strategies that policymakers can use to reduce the budget deficit. Here are a few:

- Spending reductions: Lawmakers can reduce spending by eliminating or reducing programs and services that are no longer necessary or that are not effective.

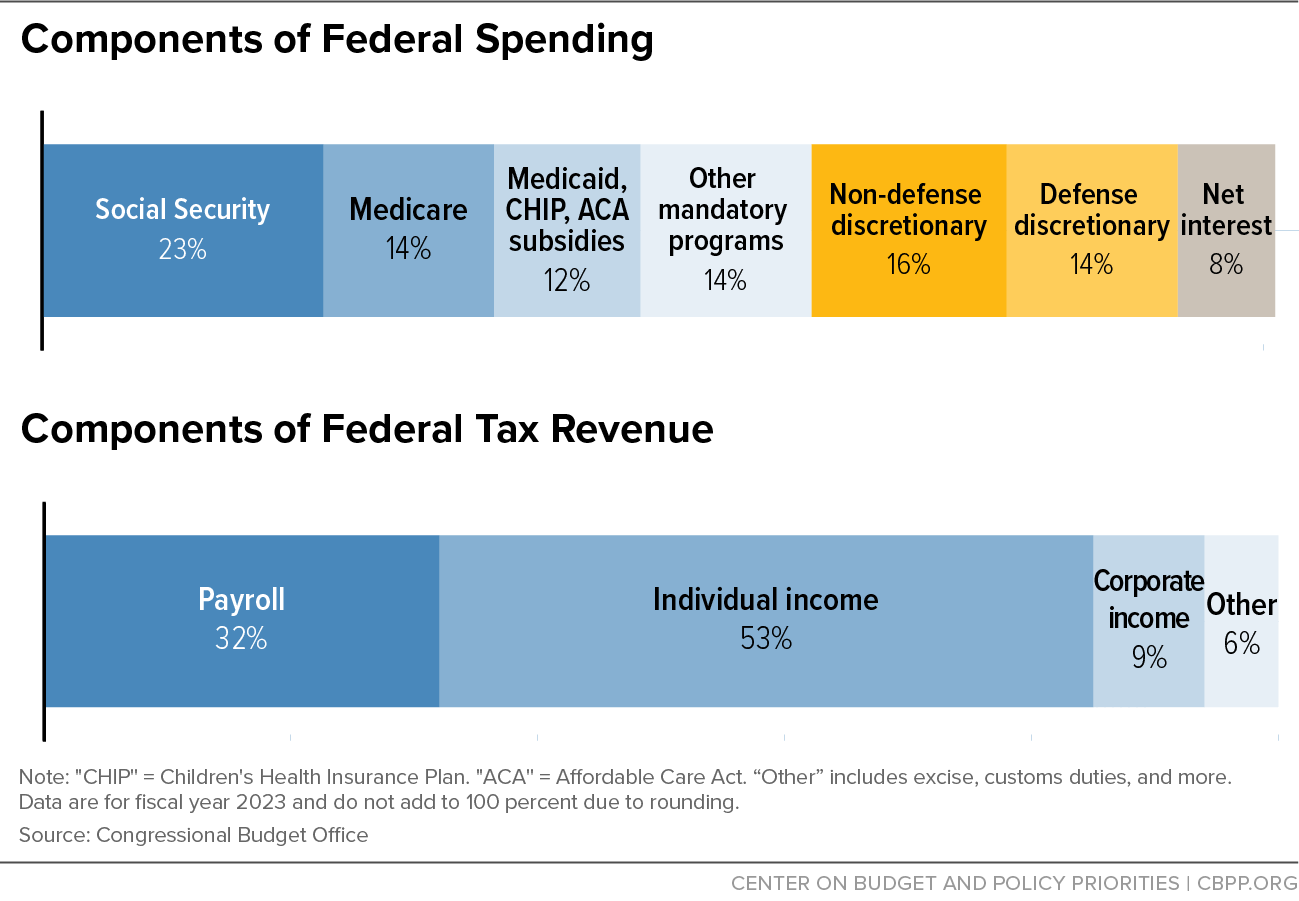

- Revenue increases: Lawmakers can increase revenue by raising taxes, closing tax loopholes, or implementing new fees.

- Entitlement reform: Lawmakers can reform entitlement programs such as Social Security and Medicare to make them more sustainable in the long term.

- Debt reduction: Lawmakers can reduce the national debt by paying down existing debt and avoiding new debt.

National Debt: Causes and Consequences

The national debt is a major concern for policymakers, as it can have far-reaching consequences for the economy and future generations. So, what causes the national debt, and what are the consequences of ignoring it?

Causes of the National Debt:

- Increased spending: The government spends more on programs and services than it takes in through revenue.

- Decreased revenue: The government takes in less revenue than it needs to cover its spending.

- Tax cuts: The government reduces taxes, which reduces revenue.

- Increased interest payments: The government borrows money to finance its spending, which increases interest payments.

Consequences of the National Debt:

- Inflation: Excessive money printing can lead to inflation, which erodes the purchasing power of consumers.

- Unemployment: A large debt can lead to higher unemployment, as businesses struggle to compete with each other.

- Loss of credit rating: A large debt can lead to a loss of credit rating, making it more expensive for the government to borrow money.

- Reduced economic growth: A large debt can reduce economic growth, as businesses and consumers are less likely to invest in the economy.

Budget Reform: A Call to Action

In conclusion, balancing the federal budget is a critical issue that requires fiscal responsibility and a commitment to reform. Policymakers must prioritize the nation's finances, reduce spending and increase revenue, and implement budget reform measures to make sure that our government is running smoothly.

Here are some steps that policymakers can take to reform the budget process:

- Implement a budget caps system: A budget caps system would limit the amount of spending in the federal budget, forcing lawmakers to make tough choices about how to prioritize spending

Jack Mcbrayer Relationships

Emmanuel Lewis

Massad Boulos

Article Recommendations

- Hisashi Ouchi

- Understandable Have A Niceay

- Jessica Tarlov Husband

- Aiden Allen Rawls

- Kaitlan Collins Husband Nationality

- Matt Mccusker

- Hilary Crowder

- Camille Monfort

- Joseph Gilgun

- Nigellater Husband